The US GDP in the first quarter of 2025 was 2% higher than in the first quarter of 2024. According to the Bureau of Economic Analysis, by the third quarter of 2025, real GDP had soared at an annual rate of 4.3%, compared to 3.8% in the second quarter. The US economic growth in the third quarter of 2025 reflects a slight decline in investment, an increase in consumer spending, and an upsurge in government expenditures and exports. The price index for gross domestic purchases and the personal consumption expenditures price index surged 3.4% and 2.8%, respectively, in the third quarter, indicating significant economic growth towards the end of 2025.

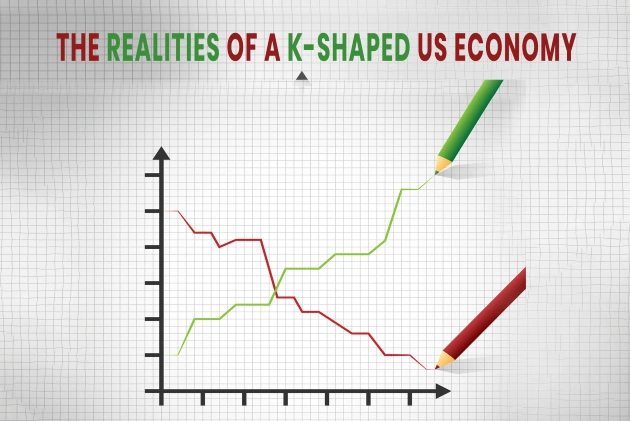

These numbers indicate strong economic growth. Although this growth has taken the country to the top of the global economy, the reality may not be as glorious. The US economy is widely considered a K-shaped economy, driven by high-income consumers and large corporations. The uneven recovery of various social segments from economic downturns in opposite directions gave it the shape of the letter ‘K’ on an economic chart. While wealthy sectors experience a rise, the lower-income households and other industries struggle to keep up, creating an increasing gap between wealth and opportunity.

Through this uneven distribution of wealth, wealthy industries and individuals are getting wealthier, while many face challenges of job security, stagnant wages, and rising costs. As the two sides of the coin tell different stories, we have delved deep to understand the reality behind the K-shaped US economy.

This article from The CEO Views is an approach to delineate the concept of the K-shaped economy, its characteristics, and the scenario of the United States, as a K-shaped economy itself. We, at The CEO Views, are committed to bringing the latest business updates and recent information on technology, innovation, and other topics to our readers. As a business magazine, we aim to cover a wide range of topics to keep business enthusiasts informed, engaged, and connected to the business world.

K-Shaped Economy: Definition and Characteristics

The latest expression of wealth inequality, the “K-shaped” economy, refers to the widening gap between the rich and the poor. This term remained the biggest buzzword of 2025, reflecting the growing disparity between large corporations and wealthy industries, and the lower-income households and smaller sectors.

The K-shaped economy is characterized by robust growth and expanding wealth, taking an economy at the top of the letter ‘K.’ Whereas, the lower section of the ‘K’ refers to the lower incomers and small businesses that struggle to gain wealth and flourish. According to the senior director and deputy chief economist of Moddy’s Analytics, Cristian deRitis, “When we think about businesses and the stock market, or we think about the labor market, some industries are hiring, others are laying off. So, I see that K-shape not only in the consumer — I think that’s where it gets a lot of attention — but it’s actually in a lot of different parts of the economy where you can see that kind of bifurcation of activity.” He believes that the “expanding separation between the haves and have-nots goes back to the stimulus relief of the pandemic.”

United States as a K-shaped Economy

The K-shaped economy speaks of the current financial scenario of Americans, while highlighting the concept of affordability as a crucial component. We have already discussed the K-shaped economy, which refers to the disparity in wealth distribution across an economy. Originating from the present economic environment of the country, the United States is now characterized as a K-shaped economy. As it experiences a growing gap between the highest earners and the richest corporations, expanding and spending wealth, and the lowest-income households and small businesses, struggling with their expenses and wealth generation.

As the Federal government continues to worry about inflation, employment, layoffs, growing defaults in subprime credit, and a “bifurcated economy,” following the short-term interest rate cut on October 29th, 2025, Reserve Chairman Jerome Powell said, “A further reduction in the policy rate at the December meeting is not a forgone conclusion — far from it. If you listen to the earnings calls or the reports of big, public, consumer-facing companies, many, many of them are saying that there’s a bifurcated economy there and that consumers at the lower end are struggling and buying less and shifting to lower cost products, but that at the top, people are spending at the higher income and wealth.”

Some industries are hiring, and some are laying off, creating a gap between high earners and low earners. The rising stock market and asset price appreciation in the country have been beneficial for the wealthiest households. Inflation and layoffs have made it difficult for consumers and small businesses to accumulate wealth for growth. The K-shaped economy in the United States is highly influencing the process by which the economy progresses, raising questions about the glorified picture of the country’s economy in the world.