Most money advice seems rather vague until the dollars and cents add up. Savings from investing when you’re 25 rather than 35 make a tremendous difference because it changes everything in a way that can’t be significantly altered by later actions. In the study from Charles Schwab, the model calculates the power of compound interest using the history of the S&P 500 index. The lesson to be learned from it is obvious: when it comes to making money, time beats everything else – not the sum invested, the investments made, or even timing the market.

The Mathematics of Starting Age

Compound interest functions exponentially. Money invested early generates returns not just on the principal but on accumulated interest, creating acceleration that late starters cannot replicate through larger contributions.

| Starting Age | Monthly Investment | Total Contributed by 65 | Value at 65 (7% return) | Interest Earned |

| 25 | $500 | $240,000 | $1,197,811 | $957,811 |

| 30 | $500 | $210,000 | $829,421 | $619,421 |

| 35 | $500 | $180,000 | $566,765 | $386,765 |

| 40 | $500 | $150,000 | $380,612 | $230,612 |

| 50 | $500 | $90,000 | $152,037 | $62,037 |

The 25-year-old contributes $150,000 more than the 50-year-old over their lifetime, but accumulates over $1 million more. Interest earned by the early starter exceeds their total contributions by nearly four times. The late starter’s interest barely exceeds half their contributions.

For every decade of delay, individuals need to invest approximately two to three times as much monthly to reach equivalent outcomes. Someone starting at 35 must contribute roughly $720 monthly to match the final wealth of someone contributing $500 monthly from age 25.

Federal Reserve Data on Current Savings Behaviour

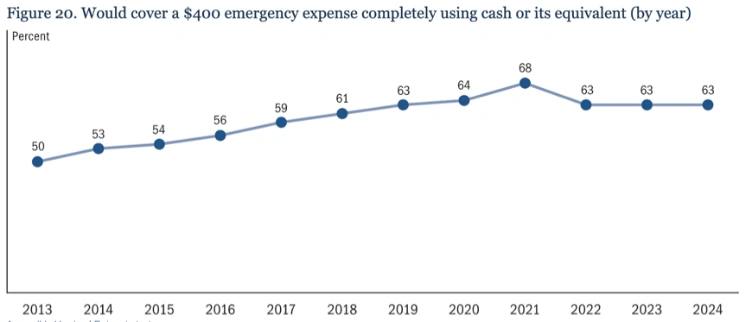

The Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED), conducted in October 2024 with over 12,000 respondents, reveals the current state of American financial preparedness.

Key findings from the 2024 survey:

- This increased by one percentage point from 2023, when it was 54%, but is a bit lower than the 59% recorded in 2021.

- Only one-third, or 35%, of adults not yet retired believe their retirement plan is on track.

- This percentage increased slightly, but still lags behind the 40% mark observed in 2021.

- Just over half (51%) spent less than they earned in the month before the survey, up from 48% in 2023.

- And 30% of adults say, well, there is no way they could afford to cover it over a period of three months.

The pandemic initially prompted improved financial behaviour. Stimulus payments, reduced spending opportunities, and economic uncertainty drove higher savings rates through 2021. Those gains have partially reversed, with current metrics stabilizing below peak levels.

Generational Savings Patterns

Bank of America’s 2025 Better Money Habits study surveyed young adults confronting higher living costs. The findings reveal persistent gaps between financial intentions and actions. Among Gen Z respondents:

- 55% lack emergency savings covering three months of expenses, essentially unchanged since 2022;

- 43% are not on track to save for retirement in the next five years, though they wish to be;

- 25% contributed to a retirement account in the past year;

- 21% invested in the stock market, up from 15% in 2023 and 2024;

- 53% do not feel they earn enough to live the life they want;

- 57% buy themselves a small treat at least once weekly.

Financial support from family is also declining for Gen Z members, and this now stands at around 50%. However, this is a decrease from last year’s statistics. Of those who are getting support, more are receiving smaller amounts, while others are receiving smaller amounts than they were last year. Despite all this, 75% of young adults claim that they have done something to improve their financial situation due to rising living costs.

Early Habits That Compound

Several studies continue to support different habits that directly impact creating lasting wealth, and one of them appears to be powerful beyond measure: ‘automatic savings.’ According to AARP, people are 20 times more likely to participate in retirement plans if automatic deductions are part of that plan. The decision-making hurdle to save manually has huge implications, and automation removes decision-making points that test personal discipline.

Meanwhile, a study bythe Consumer Financial Protection Bureau showed that if an individual pays close attention to their spending, they will have a sense of control over their money, and this will translate into movement towards their goals. The awareness that one gets from watching and tracking their spending shapes their decisions.

Ramsey Solutions’ State of Personal Finance data reveals that 43% of Americans who invest started between the ages of 18 and 25. The median starting age is 28. Only 7% begin investing after 40. Early starters gain full compounding benefits and establish habits that persist.

Understanding probability and expected value transfers across financial contexts. Platforms like Win Casino demonstrate how analytical frameworks apply to risk assessment and decision-making. The same cognitive skills, evaluating long-term versus short-term trade-offs, assessing risk-adjusted returns, and maintaining discipline despite volatility, apply directly to investment behaviour.

The Discipline Trajectory

Northwestern Mutual’s 2024 Planning & Progress Study tracked self-reported financial discipline over time. The results show consistent erosion since pandemic-era highs.

| Year | Adults Describing Themselves as Financially Disciplined |

| 2020 | 65% |

| 2022 | 59% |

| 2023 | 50% |

| 2024 | 45% |

The 20-percentage-point decline over four years suggests that pandemic conditions temporarily prompted financial housekeeping that has not been sustained. Economic uncertainty, inflation, and lifestyle normalization have contributed to declining discipline.

Debt as a Discipline Indicator

Consumer debt levels provide another measure of financial habits. According to Experian data through mid-2025, U.S. consumers carried an average balance of $104,755, with total household debt reaching $18.33 trillion. Debt composition matters significantly for wealth building:

| Debt Type | Average Balance | Typical Interest Rate | Wealth Impact |

| Mortgage | $268,060 | 6.5-7% | Asset-building (equity) |

| Auto Loan | $23,792 | 7-9% | Depreciating asset |

| Student Loan | $37,338 | 5-8% | Income potential |

| Credit Card | $6,501 | 22-24% | Pure consumption cost |

The Federal Reserve reports that debt service payments consume 11.2% of disposable income as of Q2 2025. While below historical peaks, this represents capital unavailable for investment. Reducing this ratio through debt elimination or income growth directly improves wealth-building capacity.

The Financial Literacy Gap

The TIAA Institute-GFLEC Personal Finance Index documents that American financial literacy has remained around 50% for eight consecutive years. Understanding of financial risk consistently ranks as the weakest area across all age groups. Countries with mandatory financial education show measurably better outcomes:

| Country | Financial Education Approach | Global Literacy Ranking |

| Denmark | Mandatory ages 13-15 | 1st |

| Norway | Integrated curriculum | 2nd |

| Sweden | Required coursework | 3rd |

| UK | National curriculum | 6th |

| USA | State-dependent, often optional | 14th |

Denmark requires financial education covering budgeting, saving, banking, and consumer rights for students ages 13-15. This early exposure correlates with the highest global financial literacy ranking.

The Compounding Reality

The evidence from compound interest calculations, Federal Reserve surveys, consumer debt statistics, and financial literacy research points consistently toward the same conclusion: financial discipline established early compounds into stability decades later. Delayed action requires increasingly difficult corrections.

Time is the variable individuals control least as it passes. The optimal moment to establish financial discipline was years ago. The second-best moment is now. Every month of delay shifts the mathematics further against eventual wealth accumulation, while every month of consistent saving shifts it favourably. The calculations are unforgiving, but they reward those who begin.