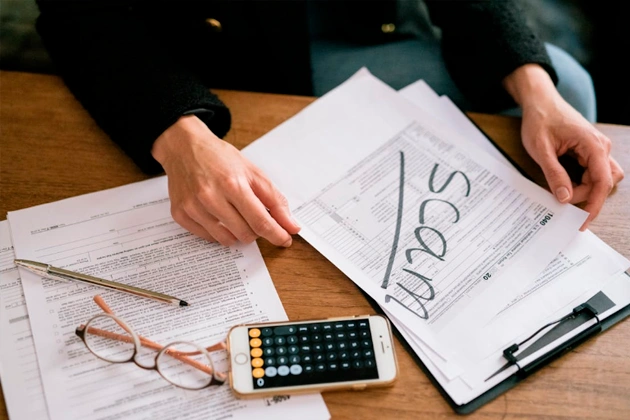

Business executives face fraud allegations more often than most people realize. The FBI investigated over 2,000 corporate fraud cases last year. Many involved successful CEOs who never expected criminal charges. These cases destroy careers and damage companies permanently.

Fraud defense works differently than other legal matters. The stakes run higher from day one. Investigations start before most executives know they are targets. Evidence collection begins quietly in the background. How you respond determines whether you walk away or face conviction.

Types of Fraud Allegations in Business

White-collar fraud covers many different business activities. Each type carries specific legal requirements prosecutors must prove. Understanding these differences helps you build a stronger defense.

Securities fraud involves lying to investors about company financials. Insurance fraud includes filing false claims or padding damages. Healthcare fraud covers billing violations and illegal kickback arrangements. Mortgage fraud means misrepresenting information on loan applications. Each category requires prosecutors to show intent to deceive.

Business executives often learn about investigations through indirect signs. A colleague receives a subpoena for documents. An auditor flags irregularities during a routine review. A whistleblower files a complaint with federal authorities. Federal agents show up with search warrants. These warning signs demand immediate action.

The government must prove you acted intentionally. Poor judgment does not equal fraud. Honest mistakes do not qualify as criminal behavior. Prosecutors need evidence showing you knew the information was false. They must demonstrate you intended to deceive others for personal gain.

How to Respond in the First 72 Hours

Your initial response shapes everything that follows. Every statement gets recorded and analyzed later. Every document you handle could become evidence. The first three days matter more than you think.

Consult this legal resource before speaking with investigators. Many executives hurt their defense by cooperating too quickly. They think explaining will clear things up fast. Investigators use early interviews to lock in statements. Later they challenge those statements with conflicting evidence.

Stop all routine document destruction immediately. Federal law prohibits destroying documents once investigations begin. Companies must issue holds to preserve everything. Employees need clear instructions about keeping emails and messages. Your phone texts matter just as much as formal memos.

Your legal team should start an internal investigation right away. This helps you find problems before prosecutors do. You can develop explanations for questionable transactions early. You might uncover helpful evidence buried in company files. Early preparation gives you more options down the road.

Building Your Defense From Day One

Federal prosecutors spend months building fraud cases. Sometimes they work for years before filing charges. They analyze financial records in extreme detail. They interview dozens of witnesses separately. They bring in expert accountants to review transactions. They build timelines showing when you knew certain facts.

Your defense must address every element they try to prove. Securities fraud cases need evidence of honest belief. Healthcare fraud requires documentation of compliance efforts. Insurance fraud demands proof of legitimate claims. The burden sits on prosecutors but preparation helps you prevail.

Expert witnesses often make or break fraud cases. You need specialists who can explain complex transactions clearly. Former prosecutors understand how government attorneys think. Industry experts testify about standard business practices. Accounting professionals break down financial details for juries. Choose your experts early so they have time to prepare.

Document trails tell competing stories in every fraud case. Prosecutors highlight emails that sound bad out of context. Your team finds communications showing good faith efforts. The side that explains the complete picture usually wins. Context matters more than isolated statements.

Selecting and Working With Legal Counsel

Attorney selection determines your chances of success. You need lawyers who understand criminal procedure and your industry. Securities fraud cases require knowledge of SEC regulations. Healthcare fraud demands familiarity with billing codes and Medicare rules. Generic criminal lawyers often miss important details.

Former prosecutors bring valuable insights to defense teams. According to the Department of Justice, fraud prosecutions follow predictable patterns. Lawyers who worked as prosecutors know these patterns well. They understand which arguments work with government attorneys. They anticipate strategies before prosecutors reveal them. They know which federal attorneys negotiate and which prefer trials.

The attorney-client privilege protects all your communications. This allows complete honesty about unfavorable facts. Your lawyers cannot defend you without knowing everything. They need bad facts from you first. Hearing them from prosecutors later creates serious problems.

When Cooperation Makes Sense

Some cases warrant early cooperation with authorities. You might provide evidence against actual wrongdoers at your company. This could help you avoid charges entirely. But cooperation requires careful negotiation and written agreements. Never cooperate without detailed counsel guidance. Immunity deals must be in writing before you talk.

Preparing for Different Outcomes

Fraud investigations follow unpredictable schedules. Some resolve within months through declination letters. Others continue for years before indictment. The waiting creates enormous stress for families. Business operations suffer during extended investigations.

Settlement negotiations often happen before formal charges. Prosecutors might accept civil penalties instead of criminal prosecution. Companies sometimes get deferred prosecution agreements. Individuals occasionally plead to lesser charges. Each option requires weighing serious legal and business factors.

Trial preparation starts long before any courtroom date. Witnesses need practice for aggressive cross-examination. Documents require organization for quick access during hearings. Opening statements need refinement through multiple drafts. Mock trials with practice juries reveal potential problems. Video recordings help witnesses improve their testimony.

Collateral Consequences Beyond Prison

The impacts extend far beyond potential jail time. Professional licenses face suspension or permanent revocation. Board positions become impossible to maintain. Business relationships end permanently. Insurance carriers deny future coverage. Banking relationships terminate without warning. These practical damages often exceed direct legal penalties.

Protecting Business Operations During Investigations

Fraud allegations affect entire companies, not just individuals. Shareholders file civil lawsuits seeking damages. Media coverage destroys brand reputation quickly. Employee morale drops when executives face charges. Vendors trigger contract clauses based on legal troubles. Stock prices fall on negative news.

Crisis communication runs parallel to legal defense strategy. Public statements need vetting by legal and communications teams. Social media posts can destroy legal positions overnight. Media interviews create quotable material prosecutors use at trial. Staying quiet often protects defendants better than explanations.

Defense costs add up quickly in fraud cases. Legal fees often exceed several hundred thousand dollars. Expert witnesses charge premium rates for analysis work. Trial costs multiply when cases go to verdict. Companies need realistic budgets identified early. Individual defendants should secure funding sources before charges arrive.

Planning for Worst-Case Scenarios

Business continuity planning should account for serious outcomes. Someone needs authority to run operations if restrictions apply. Vendor contracts must survive key executive departures. Pending deals require contingency plans. Banking relationships need backup options. These questions need answers before problems hit.

Prevention remains the smartest fraud defense available. Here are steps that reduce your risk:

- Regular compliance audits catch problems before they become criminal

- Strong internal controls limit fraud opportunities significantly

- Employee training prevents inadvertent regulatory violations

- Clear documentation shows good faith if questions arise

- Outside reviews provide objective assessments of practices

Companies that invest in prevention avoid many fraud investigations. The cost of compliance programs seems high initially. But it pales compared to defense costs later. Prevention protects your business, your reputation, and your freedom.