An eminent figure in the world of consumer rights advocacy and literature, Chuck McDowell has witnessed immense financial and professional growth, particularly as the CEO of Wesley Financial Group (WFC) LLC. Chuck’s striking net worth is the result of his unwavering and astounding contribution to the financial sector and the world of literature as well. His multifaceted professional interventions and terrific reputation have helped him engrave a métier for himself. Chuck McDowell’s net worth does not only represent his financial success but also his influential works in assisting victims of sales schemes in the financial industry.

This article profoundly unfolds the early life and successful growth trajectory of Chuck as a consumer rights advisor and author.

Chuck McDowell’s Worthy Net Worth

Chuck McDowell is a Mogul of the financial sector with expertise in aiding individuals who fall prey to financial timeshare traps and not just giving financial advice. A staunch professional within the sphere of consumer rights advisory, Chuck has committed his career to ensure to separate the wheat from the chaff of consumer rights with great potency. This dedication of his has guided him towards successful growth in his career trajectory.

What is the net worth of Chuck McDowell?

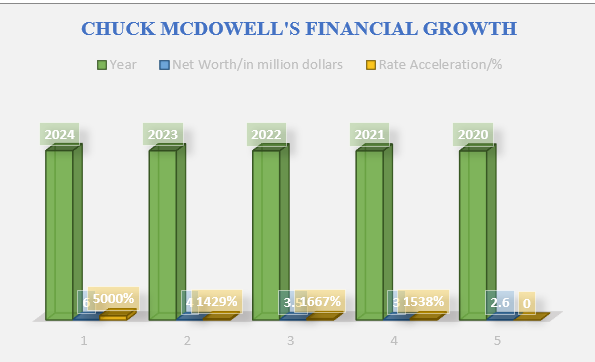

The Present accrued net worth of Chuck McDowell is a whopping $6 million as of 2024, with a yearly income of $300k. McDowell is a beacon of ethics and integrity in the ambiguous financial industry. The graphical representation of the growth in Chuck’s net worth from 2020-2024 shows a yearly heightening of his net worth, indicating his financial as well as contributory success in response to unethical sales practices.

A graph, indicating a rise in Chuck McDowell net worth

(Source: The CEO Views)

Educational Background and Turning Point of his Career

Born and Brought up in Franklin, Tennessee, United States, Chuck McDowell completed his schooling at Mount Juliet High School and later pursued a Business Administration and Management degree from Middle Tennessee State University. He started his professional career as a salesperson at a timeshare property to deal with financial crises. Putting up with the unethical sales practices for a long time, Chuck’s conciseness compelled him to resign from the job.

The damnation for selling timeshares disgusted him, and he decided to help the deceived people, recognizing his potential to do something noteworthy in this domain. This marks the most crucial turning point of his life that encouraged him to take up an ethical financial consulting advisory initiative to rescue the trapped customers. Soon after this, he embarked on the journey of founding WFC and never looked back since then.

Wesley Financial Group: An Evidence of Financial Integrity and Ethics

Chuck McDowell established Wesley Financial Group, LLC in 2011 with the purpose of offering services of timeshare cancellation and debt elimination for people who are victims of fraud, deception, and misrepresentation during sales timeshare presentations. WFC is committed to delivering authentic aid to deceived individuals and families under the inspirational and innovative leadership of Chuck.

Chuck McDowell’s net worth is the representation of his diligent work to help free over 40,000 families from timeshare debt. His expertise and advocating skills have helped him rescue individuals and families from a timeshare debt and maintenance fee of $525,000,000. With an estimated annual revenue of $52.7 million every year, WFC is transforming the picture of sales within the financial sector. In Chuck’s words- “So far this year, we’ve helped several thousand more families and individuals cancel timeshares, eliminating millions more in debt along the way.”

Lawsuit Controversies

Despite Chuck McDowell’s claim of rescuing people trapped in the fraud of sales timeshare, Wesley Financial Group faced lawsuits for violating consumer protection laws and scamming its consumers. A news report in 2020 revealed that Chuck’s Wesley does not come up as the helping hand it claims it would be. According to a lawsuit filed by Diamon Resort, Wesley is accused of misguiding customers by false promises of 100% guarantee to relieve them. In the year 2024, the vacation ownership developer Capital Vacations sued WFC for exercising fraudulent business practices. Apart from these companies, WFC faced several lawsuits from other organizations. The federal court of Nashville has unveiled WFC’s misleading consumer guiding practices.

Since the establishment of Wesley Financial Group, LLC, Chuck McDowell has proved himself as a pioneering financial advisor who has committed himself to saving persons facing fraud and deception in sales timeshare presentations. Although he is well-known for his contribution to consumer rights and the financial domain, his dedication to ethical business practices is questionable.