China produced 3.8 million tonnes of primary aluminium in September 2025, 1.8% more than in September 2024, according to the National Bureau of Statistics. The strong growth and improved profits led local smelters to keep steady production, which helped increase total output. Mysteel’s monthly survey revealed that the average profit margin among 89 smelters rose by 6.6% to Yuan 4.849/t in September. With the increasing global demand for aluminium metal, the growth of the aluminium smelting industry is expected to increase as well.

According to the new report of the International Aluminium Institute, the global demand for aluminium will increase by almost 40% by 2030. The report also revealed that the aluminium sector will need to produce an additional 33.3 metric tons to meet the growing demand. These statistics demonstrate how the aluminum smelting industry is growing rapidly and how China is standing at the forefront of global aluminium production.

This article will take you inside the rapid evolution of China’s aluminium industry, revealing how it is shaping and energising the world’s need for this essential metal.

An Insight into China’s Aluminium Industry Growth, From 1949-2025

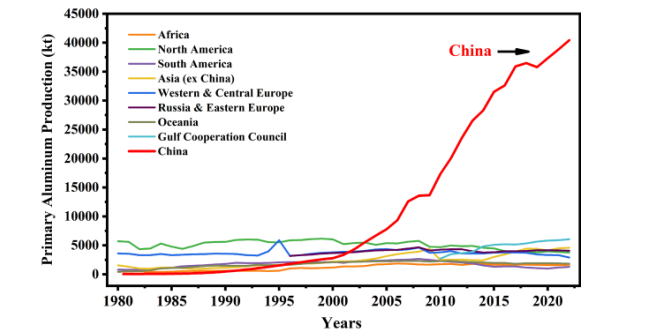

China is the largest consumer and producer of aluminium in the world, accounting for 60% of global production. According to the International Aluminium Institute, China produced more than 40 Mt of electrolytic aluminium in 2024. In the past 70 years, China’s aluminium industry has undergone exponential transformation.

After 1949, China designated aluminium as a key sector under the Ministry of Metallurgical Industry. The five-year plan of 1953-1957 witnessed the establishment of China’s first alumina refinery in Shandong and he electrolytic aluminium plant in Fushun. This laid the foundation of the industry, and by 1956, the country had its first aluminium processing facility, the Northeast Light Alloy Plant.

During the 1960s, smelters like Guizhou and Qingtongxia, along with processing plants, developed a comprehensive aluminum industry. In the late 1970s, many reforms escalated the growth of the industry, leading to its expansion and modernization. The restructuring of 1983 created the China Nonferrous Metal Industry Corporation, giving birth to refineries in Shanxi and Zhongzhou and smelters in Yunnan and Baiyin. The reforms of 1992 culminated in the establishment of the National Bureau of Nonferrous Metals Industry in 1988. In the 21st century, China’s aluminium sector expanded exponentially.

(Source: International Aluminium Institute)

With electricity prices low compared to other countries, aluminium smelters have gained cost advantages, which have accelerated the growth of the industry. After joining the World Trade Organization, China has been the net exporter of aluminium semis and manufactured products ever since. Today, companies like China Aluminium Corporation (Chinalco), Shandong Xinfa Aluminium Group (Xinfa Group), East Hope Group and Inner Mongolia Huomei Hongjun Aluminium & Electricity (Huomei), Hongqiao Group, dominate the Chinese market.

China’s Aluminum Smelting Industry Growth 2025

In the 1980s, China introduced a Japanese 160kA prebaked-anode aluminium reduction potline, marking the beginning of modern aluminium smelting with large-scale reduction cells in China. However, the process used an outdated fixed-time feeding control model, a high anode effect coefficient, and a high molecular ratio, which resulted in less-advanced technical and economic indexes with a current efficiency of 87%.

Over time, tech-based, intelligent, optimised production of aluminium electrolysis started to take place. Technologies, including digital twin and distributed sensing, led to intelligent decision-making in the smelting process. With demand for aluminium shifting toward automotive and renewable sectors and China’s high reliance on Bauxite, the country witnessed an increase in the smelting of aluminium.

According to SMM, domestic aluminium production of China increased by 3.11% MoM in July 2025. The capacity of operating aluminium in China also increased a bit in July, mainly because of the start-up of the aluminum Phase-II replacement project in Shandong-Yunnan. While talking about China’s aluminium smelting industry growth 2025, we have found that alloy production in several regions decreased significantly due to the strong off-season climate in the end-user market. The proportion of liquid aluminum in domestic aluminum smelters in July reduced notably, with the industry’s liquid aluminium proportion declining 2.06% MoM to 73.77%. The domestic casting aluminum ingot volume in July declined by 9.34% YoY and increased by 11.89% MoM to approximately 976,300 mt.

According to the International Aluminium Institute, China’s primary aluminium production grew by 2.6% in the first quarter of 2025. The massive investment in primary metal smelting capacity has skyrocketed Chinese production to 43 million in 2024. China’s growing dominance of the global aluminium supply chain is increasing resistance from Western countries in the form of trade complaints and, recently, in the form of US tariffs.

However, things will soon change as Beijing’s aluminium Action Plan for 2025 to 2027 confirms that the capacity capital is in place, and the country’s production can exceed the capital. But AZ China estimates that capacity utilization is already high at 98.2% and it’s evident that China’s aluminium production growth is slowing down from the average 4% annual rate. Chinese operators are still establishing small smelters, but the new capacity should be offset by the closing of older capacity.

The CEO Views excels in giving coverage to the most trending global business topics, including technology, industrial development, and more. With our business publication, we aim to connect peers through articles, blogs, profiles, and news.