Has your Medicare Advantage Plan recently been discontinued? Are you wondering what’s next to continue to avail the plan benefits? Are you someone confused about your Medicare rights under a Medicare Advantage plan? This article can be your guide in helping you understand your Medicare rights and how you can overcome the challenges associated with the Medicare Advantage Plan.

Before we get into the nuances of the plan, let’s explore what the plan is, its types, and how they work.

Medicare Advantage Plans: Your Ultimate Partner in Securing Health

Medicare health plans deliver both Part A (Hospital Insurance) and Part B (Medical Insurance) benefits to people with an active Medicare plan. Generally offered by private companies in contract with Medicare, these plans include Medicare Advantage Plans (Part C), Medicare Cost Plans, Pilots, and Program of All-inclusive Care for the Elderly (PACE).

One with Part A and Part B can join a Medicare Advantage Plan, known as ‘Part C” or “MA Plan.” Medicare-approved private companies deliver this type of health plan. Most Medicare Advantage Plans give drug coverage (Part D). Listed below are various Medicare Advantage Plans that have some common and different benefits.

-

Preferred Provider Organizations (PPOs)

One can get this Medicare Advantage plan from a private insurance company. PPOs have networks of doctors, healthcare providers, and hospitals. Under this plan, the insurance holder can pay less when visiting providers and healthcare facilities that fall under the plan’s network. However, one can go to out-of-network providers for covered services, but in that case, one will have to pay more.

-

Health Maintenance Organizations (HMOs)

Similar to PPOs, an HMO allows the insured to get their care and healthcare services from doctors, hospitals, and other healthcare providers in the plan’s network. However, this plan has some exceptions when it comes to emergency care, out-of-area urgent care, and temporary out-of-area dialysis.

Additionally, some HMOs are Point-of-Service plans that may allow the policyholder to get some services out-of-network for a higher coinsurance. It’s crucial to follow the plan’s rules when the plan requires it, for instance, getting approval for a certain service.

-

Medicare Medical Savings Accounts (MSAs)

The Medicare Medical Savings Accounts Plan is a consumer-directed MAP. Similar to Health Savings Account Plans, these plans can be availed from an employer or from the Marketplace. Unlike PPOs and HMOs, these plans do not have a network of doctors, care providers, and hospitals. These plans let you choose your healthcare services and providers.

MSA Plans combine two key elements: a high-deductible health plan and a Medical Savings Account. The high-deductible plan only begins to pay for your care after you reach a significant annual deductible. In contrast, the Medical Savings Account acts as a yearly gift from Medicare, depositing funds at the start of each year to help cover your health care expenses.

-

Special Needs Plans (SNPs)

An SNP offers benefits and services to people suffering from severe chronic diseases, specific health care needs, or those who have Medicaid. SNPs include care coordination services and tailor benefits, provider choices, and a list of covered drugs to meet the specific needs of the group they serve. They have similar coverage to HMO or PPO plans. Additionally, it may cover extra days during your hospital stay if you have severe health conditions like cancer or congestive heart failure.

-

Private Fee-for-Service Plans (PFFs)

PFFs are not the same as Original Medicare or Medigap. It determines how much it will pay doctors or health care providers, and hospitals, and how much the insured must pay when they receive care.

Discontinuation of a Medicare Advantage Plan: What You Should Know?

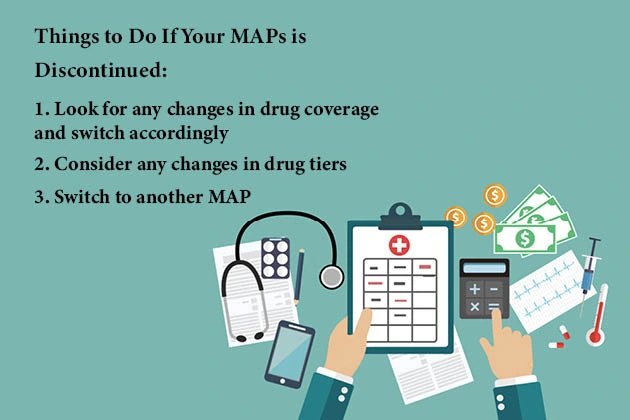

If you are wondering what to do if your Medicare Advantage plan is discontinued, here is all you should know.

- For MAPs with drug coverage, you must look at whether or not your medications have been removed from the formulary. If removed, you may have to switch to medications that are on your drug PL or have to pay more to continue with your previous medications.

- Also, if a drug is moved from tier 3 to tier 4, this means your plan may have shifted from a flat co-pay to a percentage co-insurance. This increases your cost responsibility.

- You can switch to another MAP plan from the same insurance plan.

A Glimpse of Your Medicare Rights

It does not matter where you are getting your Medicare plans from; there are some rights and protections that you should be aware of. If you have an active Medicare plan, you have the right to be treated with courtesy, respect, and dignity at all times and should be protected from discrimination. Every company working with Medicare must obey the law and cannot treat you differently for your race, color, disability, age, religion, gender, or national origin.

With a medicare plan, you have the right to have your personal and health information kept private. You must also have access to doctors, hospitals, and specialists for medically necessary services. You also have the right to get Medicare-covered services in an emergency, information in an understandable form from Medicare, healthcare providers, and, under certain circumstances, Medicare information and health care services in a language you understand, Medicare information in an accessible format, answers to your Medicare questions, and a decision about health care payment, coverage of items and services, or drug coverage.

The CEO Views has been serving as a bridge between industry peers to help them fill the knowledge gaps by addressing diverse industry topics through articles, news, and blogs. We take pride in our approach to delivering first-hand information to our readers.