It’s no secret that the process of taking out a loan can be confusing. There are many different types, terms, and features to consider when applying for a new loan. The good news is that there are plenty of resources available to help you understand it all! This blog post will provide an easy guide explaining the process of taking out a loan.

Choosing Your Financing Option

There are several options when it comes to financing your education potential, and you need to assess which option is best for you. You can either take out student loans, search for where to get payday loans online, ask parents or family members to help finance the costs related to higher learning, use personal savings (if available), grants, and scholarships, work part-time during school years if possible, or even full-time while studying to save up money. There’s no right answer as this will depend on many factors such as current situation, income level, type of institution attended, etcetera. However, one thing that is important not to forget about is affordability – be sure that whatever choice you make won’t result in a financial burden too high for your household budget.

The Application Process

The application process varies depending on your choice of financing but is usually composed of a series of steps that need to be fulfilled before being able to access the funds.

For example, when it comes to student loans, you will have an easier time as most schools and educational institutions offer students additional support through subsidized or unsubsidized federal loan programs. These are eligible for those enrolled in undergraduate courses only – graduate school applicants cannot apply for these types of funding aid unless they receive their degree from a previous program first. When applying for this type of financial assistance, you also don’t need credit checks so long as you meet all eligibility criteria such as citizenship status (if not born here), current enrollment at least half-time, etc.

Once you are awarded the loan, there are only a few requirements to remember to keep them active: full-time enrollment status (must be at least 12 credits/semester), timely completion of all courses for each semester, and on-time submission of any financial aid forms or other documentation requested by your school. If you happen not to meet these terms, then your loans will become inactive, which means that they cannot be used again until certain conditions are met. Failure to abide by these regulations may also lead to deferment or forbearance for repayment options if one does not wish to make payments during this time but is still obligated contractually up until their agreement expires after an agreed-upon number of years have passed since signing it.

The Repayment Process

The repayment process for federal student loans can be a bit complicated because there are multiple options available to you. However, the most common one is through an income-based payment plan that will cap your monthly expenditures depending on how much money you make each month after taxes and other deductions have been taken from your salary or wages. You may also opt to pay off your loan faster by using either of these two methods: extended repayment plans allowed up to 25 years in duration (the maximum length) or graduated repayment, which works well if you know ahead of time when exactly you expect higher earnings later on down the road during employment status changes such as going from being a salaried employee into self-employment where costs increase due to additional tax payments.

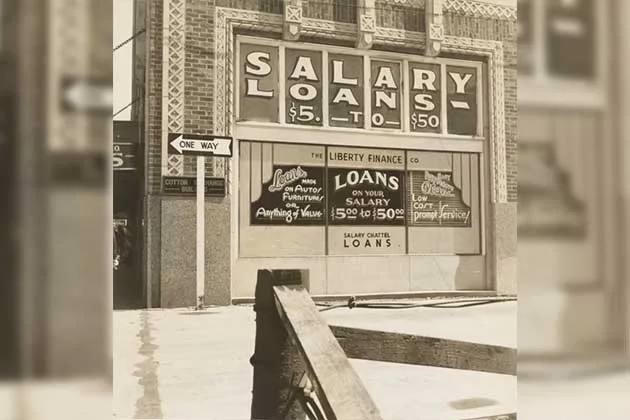

Types of Loans

Federal Loans are available to all students enrolled in accredited institutions regardless of citizenship status because they are subject to the Department of Education’s Direct Loan Program. These loans can be subsidized or unsubsidized depending on your financial aid application, eligibility criteria, and academic progress made during enrollment at school. If you happen not to meet these conditions then you may have applied for an alternative loan called a private one that is usually offered by banks, credit unions, and other lending institutions. However, these come with higher interest rates than those provided through the government because there isn’t any type of collateral needed as long as you qualify (credit score matters here).

Private Loans offer much more flexibility in terms of repayment schedules as they can be extended up to 30 years or longer if needed and interest rates are usually lower than those for federal loans depending on your credit score, income levels set by lenders, etc. The catch here though is that these funds aren’t guaranteed through the government so there isn’t any type of insurance offered, thus creating additional risk for students who may not have perfect scores or enough collateral (if not outright cash available).

Types of Collateral

Collateral is used as a way to secure repayment of the funds that you borrow from lenders by pledging something valuable, such as real estate or vehicles. The most common type of collateral for student loans though will be your future earnings and income if this cannot be shown through tangible items (hard assets) like houses, cars, boats; however, there are other options available too, such as life insurance policies which may pay out enough cash to cover the full amount due with additional money left over, but these can come at very high costs depending on how much is needed per month, so it’s not recommended unless necessary.

By understanding how loans work, you will be able to choose the loan that is best for your situation. There are many different types of loans available, so it can take some research and time to find which one works best for you. By taking the time to learn about what each type entails, you should have no problem choosing a great deal when applying for any kind of personal or business loan in the future.