Corporations that experienced three or more critical risk events in the past twelve months represent 41% of all organizations surveyed by Secureframe. This figure alone explains why risk management has moved from compliance checkbox to strategic priority. The question is no longer whether to invest in risk awareness but how to calibrate that investment for maximum return.

The global risk management market reflects this shift. According to IMARC Group, the sector is projected to reach $35.9 billion by 2032, growing at 13% annually. Organizations are spending because the alternative – reactive crisis management – costs more.

The Financial Case for Proactive Risk Management

IBM’s research on incident response provides the clearest cost-benefit analysis available. Organizations with dedicated incident response teams that regularly test their response plans saved $2.66 million in breach costs compared to those without such preparations. That represents 58% cost savings from a relatively modest investment in planning and testing.

The breakdown of what drives these savings:

| Factor | Impact on Costs |

| Having an incident response team | Reduced breach costs by 23% |

| Regularly testing the response plan | Additional 35% reduction |

| Security AI and automation | Average savings of $1.76 million |

| Employee training programs | 12% reduction in breach likelihood |

Nearly three-quarters of organizations now maintain incident response plans, but only 63% test them regularly. The gap between having a plan and validating it represents significant unrealized value.

How Executives Perceive Risk

PwC’s global surveys consistently show that executive risk perception drives resource allocation. Current top concerns among business leaders:

- Economic conditions: 58% of leaders flag this as a primary risk;

- Cyber attacks: 40% cite this as a serious threat;

- Third-party relationships: 31% view vendor risk as the greatest threat to growth;

- Talent acquisition and retention: 61% identify this as a top risk looking toward 2034.

The shift toward third-party risk deserves attention. Organizations increasingly depend on external vendors, cloud providers, and supply chain partners.

Data Quality as Risk Factor

McKinsey research identifies poor data quality as the data-related risk of greatest concern for 58% of risk professionals. The consequences extend beyond inaccurate reporting:

- Lost revenue from missed opportunities;

- Reduced operational efficiency;

- Reputational damage from flawed analyses;

- Compliance failures from incomplete records;

- Average annual losses of $15 million are attributed to data quality issues.

Organizations making decisions based on unreliable data compound their risk exposure. Every strategic choice built on faulty information carries embedded uncertainty that proper data governance would eliminate.

Investor Risk Tolerance and Decision Patterns

Research into financial decision-making shows consistent patterns in risk management. One such study, investigating behavioural biases and their impact on investment decisions in Cogent Economics & Finance, extracted that prospect theory, herding behavior, and mental shortcuts are the major elements influencing an investor’s attitude toward risk. Key findings from the research:

| Behavioural Bias | Effect on Risk Perception |

| Disposition effect | 0.665 coefficient increase in investment likelihood per unit increase |

| Herding behaviour | Significant positive correlation with risk-taking |

| Overconfidence | Higher risk tolerance but lower actual returns |

| Loss aversion | 2.5x stronger reaction to losses than equivalent gains |

This is called a disposition effect, and the tendency to sell winning wagers too quickly and losing wagers too slowly is harmful. This is related to how people process risk and is a skewed perspective as they seek choices that are not really in line with what they want to accomplish.

Practical Implementation

Organizations seeking to improve risk awareness should consider sequential implementation:

- Establish baseline metrics for current risk exposure and incident frequency;

- Create cross-functional risk assessment teams combining technical and business expertise;

- Implement regular testing of response plans rather than one-time documentation;

- Develop scenario planning capabilities for emerging risk categories;

- Build a data infrastructure that supports real-time risk reporting.

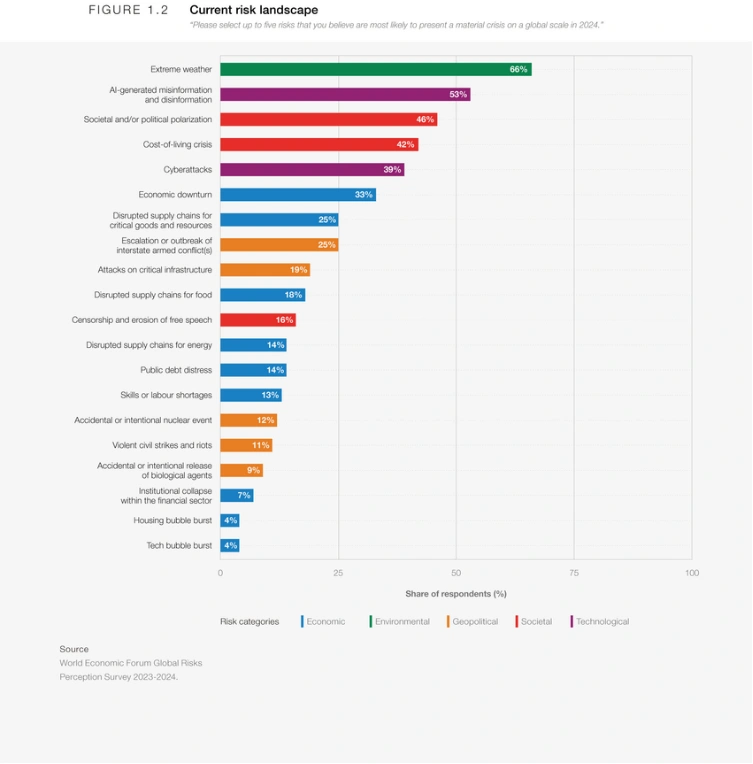

The World Economic Forum’s Global Risks Report 2024 provides sound benchmarking insights. For 2024, extreme weather is rated by roughly two-thirds of all respondents (66%) as the risk that will set off a material crisis. At 53%, AI-generated misinformation is a close second, with societal polarization also alarmingly high. Organizations can start matching their preparedness to such widespread expectations.

Investment in Risk Technology

Global spending on security and risk management reached $215 billion in 2024, according to Gartner estimates. This investment flows toward:

- AI-powered threat detection and response automation;

- Integrated governance, risk, and compliance platforms;

- Real-time monitoring dashboards for board-level reporting;

- Climate risk modeling for physical and transition risks;

- Third-party risk assessment tools.

The technology investment makes economic sense when compared to breach costs. Organizations with security AI and automation averaged $1.76 million in savings per breach event. The payback period for risk technology is often measured in months rather than years.

Connecting Risk Awareness to Opportunity

Risk management frameworks increasingly incorporate opportunity identification alongside threat mitigation. The same analytical capabilities that identify potential losses can highlight underexploited advantages.

Platforms like Win Bet demonstrate this principle in action – sophisticated risk assessment creates value for participants who understand probability distributions and can act on that understanding. The analytical skills transfer across domains: an investor comfortable with portfolio risk calibration applies similar thinking to career decisions, business partnerships, and major purchases.

Organizations that view risk management purely defensively miss half the value. Proactive risk awareness reveals where competitors are overexposed, where market conditions favour bold moves, and where conservative positioning creates unnecessary opportunity costs.

The Cost of Inaction

The 41% of organizations experiencing multiple critical risk events annually serve as a control group for risk management effectiveness. Their experiences quantify what happens without adequate preparation:

- Extended recovery times from preventable incidents;

- Higher insurance premiums reflecting elevated risk profiles;

- Reduced access to capital markets and partnership opportunities;

- Talent flight as employees seek more stable employers;

- Regulatory scrutiny and potential penalties.

Organizations with robust risk frameworks avoid these costs while gaining competitive advantages in markets where stability signals reliability.

Measuring Risk Management Value

Quantifying risk management ROI remains challenging but increasingly achievable. The most credible approaches include:

- Comparing incident costs against industry benchmarks;

- Tracking insurance premium trends relative to coverage levels;

- Measuring response times and recovery speeds;

- Surveying stakeholder confidence and trust levels;

- Calculating opportunity costs of risk-induced delays or cancellations.

Over 81% of individuals surveyed by ProcessUnity and CyberGRX reported the ability to quantify and communicate the value of their third-party risk management programs to business leaders. The capability to demonstrate ROI transforms risk management from a cost centre to a strategic asset.

Risk awareness influences every significant financial and business decision. The organizations and individuals who develop sophisticated risk assessment capabilities consistently outperform those relying on intuition alone. The data support investment in risk management infrastructure, testing, and continuous improvement. The question is not whether to prioritize risk awareness but how quickly to build the necessary capabilities.