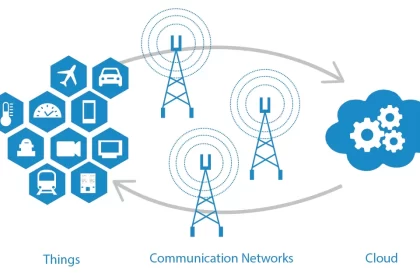

The rise of digital players in the financial industry has eased the common man’s burden to get access to funds. After the COVID-19 outbreak, digital transformation has created an overwhelming buzz. Digitalization in the finance sector is critical to surviving in this competitive setting. Fintech has arisen as the most strong lending platform, in this case, changing the traditional banking method and the end-to-end customer journey.

Financial technology or fintech has opened numerous possibilities for tapping the vast significant customer database that enables a robust digital foundation. It digitalizes company activities, enhances production capabilities, utilization of funds, and efficiency of employees. It also offers expanded customer experience by acquiring deeper behavioral insights and adds a level of transparency.

The global financial technology market is expected to hit US$460 billion by 2025.

Digital Transformation is Transforming Finance Sector

Fintech combines all the new technology that banks and financial companies use to optimize financial services delivery. Services such as automated banks and blockchain systems that use ATMs and electronic cards are involved. Financial technology has revamped the finance industry by using automation and machine learning approaches to improve customer service. The utilization of 24×7 open automated chatbots, online budgeting tools to track money spending, and a spending tracker to track funds are included in potential fintech money-makers.

All pain points in financial business operations are solved at each level by combining automation technology and machine learning (ML). Fintech focuses on overcoming operational issues such as budgeting and support for customers. To validate transactions, irregular financial practices that usually elicited a phone call from a bank representative may now use robocalls. While this strategy is challenging, it is not acceptable to question its efficacy.

Fintech will no longer have a supernatural presence in the financial sector, like all financial institutions, like banks and MSMEs. They fully support fintech and see it as an opportunity for investment.

Prospects for the Future of Digital Technologies in the Finance Sector

It is no longer an option to stick to old analog methods and manual habits for any industry, including the financial sector. And the introduction of digitalization is a must for those trying to boost performance and competitive appeal.

Maximizing Data Use

The financial sector is a golden moose of customer information as one of the first sectors to gather consumer data. However, without the analysis and interpretation that can turn it into a valuable business asset, this information has very little value. The link between raw data and intelligence used in everything from business strategy to optimizing customer relationships is digital transformation.

Enhancing Product Delivery

Digitalization greatly benefits financial services products. Digital products lead to efficiency and process savings, and detailed attraction. Millennials are a crucial generation for the financial industry, and demands within that demographic are based on enticing products. The products have to be readily available, versatile, and low-cost. Digitalization allows companies in the financial sector to grow by allowing these features.

Customer Interactions

The ability to develop consumer interactions is provided through digitalization in the financial sector. This industry will support various customers through digital transformation, from customer service bots to concise and straightforward apps and social ads, speaking a language they understand. A higher market benefit is attributed to the result of continuing relationships.

Embracing digitalization starts with organizational structures and processes. It could assist in providing data analysis and reporting to other systems for incorporation. Fintech is also a thorough improvement for financial institutions and meets the requirements of businesses.