Retail leaders are counting on about 5% revenue growth in 2025, yet Deloitte warns that fragmented consumers, rising costs, and stubborn tech debt could derail that ambition. When point-of-sale software code predates mobile wallets and aging frameworks block AI pilots, every expansion idea hits a ceiling. Turning upbeat forecasts into real cash flow now hinges on modernization moves that fit mid-market budgets and deliver mobile-first, AI-ready capabilities—without another lengthy rip and replace saga.

Legacy lock-in erodes margin

Frozen code means frozen cash flow. Deloitte’s Tech Trends 2024 study showed that 70% of technology leaders rank technical debt as the top barrier to innovation and productivity, and developers now spend about one-third of their time tending that debt instead of creating new value. The 2025 US Retail Industry Outlook echoes the pain, calling legacy systems a “make-or-break” hurdle for growth as retailers chase omnichannel capability and personalized engagement.

Every patch applied to an end-of-support framework raises operational costs, slows page loads, and adds security exposure that finance teams rarely budget for. Meanwhile, marketing teams cannot launch mobile checkout upgrades or AI recommendations if the core stack cannot support modern APIs. Until these aging foundations are replaced or wrapped with modern layers, each incremental revenue idea stalls on the launchpad, quietly compressing EBITDA and shareholder confidence.

Hidden costs behind the dashboard

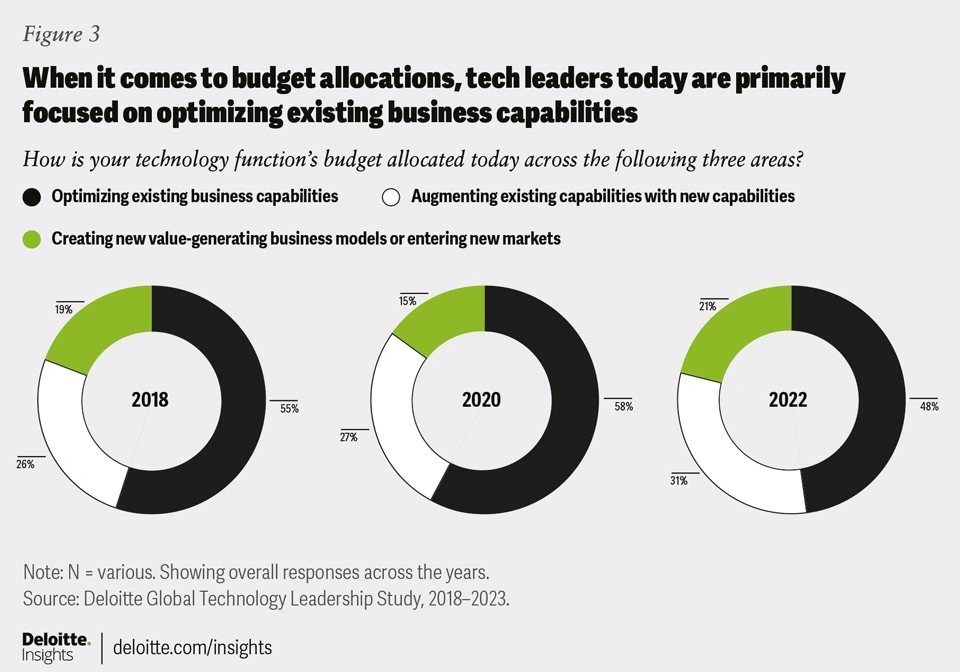

Deloitte’s 2023 Global Technology Leadership Study shows 48% of tech budgets still go to “optimizing existing capabilities,” meaning routine upkeep rather than new growth initiatives—maintenance drag that soaks up nearly half the capital executives would rather aim at revenue expansion.

Source: https://www.deloitte.com/us/en/insights/topics/leadership/maximizing-value-of-tech-investments.html

Breach exposure compounds the leak: IBM’s Cost of a Data Breach 2024 states that an average incident costs $4.88 million, turning every unpatched framework into a latent multimillion-dollar liability. Finally, talent churn drains momentum; Stack Overflow’s 2024 Developer Survey reveals 62% of engineers cite technical debt as their top workplace frustration.

As we can see, maintenance overhead, breach fallout, and attrition together erode margin long before a single modernization invoice hits the board deck.

Modernization paths that fit mid-market budgets

Modernizing legacy retail tech no longer means betting the company on a single, years-long overhaul. Instead, CEOs now stitch together a series of focused moves—retiring sunset frameworks, grounding operations on a future-ready core, embracing mobile-first design, and integrating business-driven AI—to unlock value in short bursts while keeping day-to-day business running.

The first hand-off is retirement. Running customer-facing apps on stacks the vendor has already abandoned is a risk no audit committee wants to defend. As an example, Microsoft has discontinued support for Xamarin, halting new APIs and security fixes, and Apache has likewise dropped Windows support for Cordova, a clear signal the framework is winding down.

Next comes replacement with a future-ready core. Flutter is now used by 42% of mobile developers worldwide, making it the most popular cross-platform framework. Flutter’s single code base shortens release cycles and sidesteps the licensing fees that often hide inside proprietary toolchains—an easy win for CFOs watching every line item.

With a modern core in place, brands can go mobile-first. Salesforce tracked the 2024 holiday rush and found 79% of US e-commerce orders were placed on smartphones, proof that desktop-centric roadmaps leave money on the table. Designing every journey for thumb navigation and one-tap checkout protects revenue and improves net promoter scores without adding large engineering bills.

Finally, generative AI has moved from experiment to baseline capability for enterprise productivity. Retailers can start small with AI agents to forecast demand, automate inventory, or adopt conversational product search—and pay for expansion with the savings those pilots generate.

Each of these steps can be executed behind an API gateway or micro-frontend that isolates new services from legacy cores, allowing teams to introduce value in 90-day increments while the store stays open and customers keep checking out. Taken together, retiring sunset stacks, prioritizing mobile, covering multiple platforms, and adding business-ready AI create a modernization playbook that delivers results without blowing up the budget.

Top 4 tips for choosing the right retail software developers

Selecting the right technology partner is less about raw coding capacity than alignment with your board’s growth plan. The five filters below help CEOs identify true collaborators and ensure every modernization dollar turns into business value.

Retail domain knowledge. Teams that discuss turnover velocity and shelf schematics as comfortably as AI models training and APIs detect revenue leaks faster than generalists, compressing discovery time that can be redirected toward expansion planning.

Proof of outcomes. Ask for live examples of launched products, together with business metrics improved due to modernization.

Mobile-first, AI-forward mindset. Retail software developers should demonstrate recent multi-platform rollouts and working AI pilots rather than slide decks.

Transparent roadmap with KPIs. Deloitte cataloged 46 digital-transformation KPIs and found over half are ignored by most firms, leaving value invisible until overruns surface. Vendors that publish milestone targets, cost ceilings, and service guarantees before coding keep those gaps closed.

Score candidates against these filters and your modernization push will stay on time, on budget, and finely tuned to omnichannel shoppers.

Future-proof growth begins today

Retail boards may target roughly 5% revenue expansion, but that upside only materializes when obsolete software systems stop draining budgets and talent.

Retiring unsupported frameworks, standardizing on a future-ready core like Flutter, designing every journey for mobile shoppers, and rolling out pragmatic AI pilots converts technical debt into new cash flow without risks.

The final variable is people: bring in retail software developers who pair domain insight with transparent KPIs and a proven engineering track record, and each 90-day sprint will show concrete, board-level progress.

Modernization starts small, scales fast, and, done well, keeps your company thriving long after today’s growth targets become tomorrow’s baseline.

Retail modernization also delivers a competitive intelligence dividend: unifying inventory, customer, and sales data in a single analytics layer gives executives real-time visibility into margin drivers, seasonal demand, and emerging shopper preferences, enabling smarter promotions and faster pivots even while back-end upgrades roll out behind the scenes.