Customer Analytics is becoming critical as businesses seek to retain, acquire, satisfy, and engage their customers effectively to grow business, these days. An organization has an effective approach in analyzing its business performance. Today, consumers have access to information at any time, anywhere, where to search and shop, how much to pay, etc., which makes it essential to gain insight into the customer and understand how they can behave when interacting with a brand so that a business can react accordingly.

However, evaluating a massive amount of customer-created data is a complex process. But, using this data gives businesses the ability to tailor communications, forecast customer turnover, segment consumers through demographic data, and use different platforms for custom research.

How to Utilize Customer Analytics?

By using different metrics to scale up and analyze data, organizations can create successful customer experiences. Customer analytics is usually handled by an interdisciplinary group and different departments within the company, including marketing, sales, IT, customer service, and business analysts. Thus, in order to get the most useful insights based on the actions of the consumers, the teams will consider the business metrics to select which can help to achieve a single view of the customer experience.

There are various best practices in customer analysis that businesses can use to make superior business decisions, including evaluating and understanding customers about a brand; targeting customers across all platforms and measuring a product and service in different ways; identifying big data patterns as well as scrutinizing online habits to improve sales, and optimizing consumer journey by personalized sales and market segmentation.

Most companies today gain advantages from customer analytics by using multiple networks by using various kinds of customer data. Organizations exploit their consumer data in retail to restructure the market management. And this change also takes place in complex scheduling and employee evaluations. Customer Analytics allows retail businesses to assess employees by equating daily revenue to regular in-store traffic.

In finance, banks, insurance companies, and most financial startups take advantage of customer insights by identifying customer loyalty value, recognizing customers below zero, through cross-sales, controlling customer retention, and targeting moving customers to lower-cost channels.

Capitalization on Customer Analytics Tools

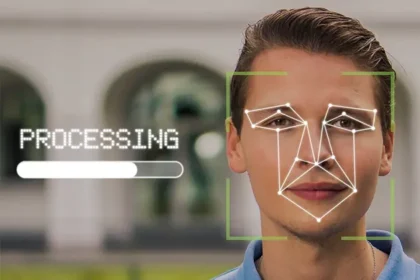

To predict a customer’s buying behaviors and lifestyle preferences, businesses need customer analytics tools in an attempt to obtain customer perceptions and insights. Many large corporations provide a broad variety of customer analytics tools to analyze customer behavior, helping businesses build marketing strategies for different segments of customers. The customer data analysis tools can be part of a Customer Relationship Management (CRM) suite or marketed as standalone applications that do everything from gleaning customer engagement to analyzing and visualizing data.

Many customer analytics tools come with features such as user segmentation and systems that optimize websites and do marketing campaigns for niches. These resources link to can sales and marketing applications, alongside email, online content management systems, social media networks, and customer loyalty services.

So, customer analytics is a process in which data or insights from customer behavior is used to eventually make vital and better business decisions. Furthermore, better the understanding of a customer’s purchasing habits; the more comprehensive predictive behaviors become a reality.